What if you would like to benefit charity, but the need for an income stream makes you hesitant to part with assets you might otherwise give?

Two charitable techniques are available that may meet your needs. One is a charitable gift annuity (CGA). The second is a charitable remainder trust (CRT). My previous post discussed CGAs. This post discusses CRTs.

Charitable Remainder Trusts Described

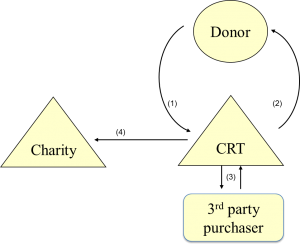

A charitable remainder trust (CRT) is just like any other trust – it has a “trust settlor” (or “trust grantor”) who establishes and funds the trust, a fiduciary administering the trust (the “trustee”), and beneficiaries receiving income from the trust and remaining trust assets at the time the trust terminates.

As in the case of any other trust, the arrangement between the three parties is memorialized in a trust agreement. The key differences between a CRT and other trusts are that

(1) a CRT is a tax-exempt entity,

(2) the trust “remainder” beneficiaries must be qualified charities,

(3) the income beneficiaries of a CRT must include a non-charitable beneficiary and

(4) the person funding the trust (the settlor) is entitled to claim an income tax deduction in the tax year that the CRT is funded. The income tax deduction equals the value of the trust’s remainder interest at the time the CRT is funded.

Basic Rules

- All CRTs share the following characteristics:

- At least one non-charitable income beneficiary

- Income payout must be at least 5 percent, but no more than 50 percent

- Payout is set based on the value of trust assets either as valued when the trust is funded (in the case of an “annuity” trust), or as assets are revalued annually (in the case of a “unitrust”)

- Trust term (how long the trust will last) can be no more than 20 years, for the lifetime(s) of a measuring life(s) or a combination of a lifetime(s) and a term of years not to exceed 20

- Remainder beneficiary(ies) of the CRT must be a qualified 501(c)(3) charity

- CRTs are tax exempt

- Non-charitable income beneficiaries of the CRT are subject to tax on distributions from the CRT in the year the distribution(s) is received.

CRAT or CRUT?

Charitable remainder trusts can be structured in numerous ways. The two basic categories are charitable remainder annuity trusts (CRATs) and charitable remainder unitrusts (CRUTs).

The primary difference between the two basic categories is how the income payment is calculated. In the case of a CRAT, the payment is based on the value of assets transferred to the CRAT at the time the CRAT is funded. For a CRUT, the annual payment from the unitrust varies from year to year, and is calculated using the value of the assets held by the trust as those assets are re-valued on an annual basis.

For example, if you transfer $500,000 of stock to a CRAT with a 5% annual payout, the annual income payment from the CRAT will be $25,000 every year of the CRAT’s existence.

Alternatively, if you donate assets valued at $500,000 to a 5% payout CRUT on January 1, the income beneficiary would receive $25,000 during the first year of the CRUT. If the value of the CRUT assets are $510,000 the following year, the income beneficiary would receive $25,500. Conversely, if the following year the CRUT assets are worth $450,000 on the annual valuation date, the income beneficiary payment drops to $22,500.

CRT Illustrated

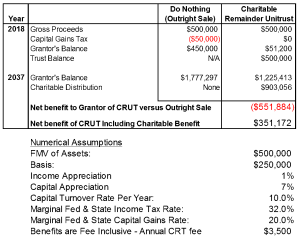

Result of Implementing a CRT

The following table illustrates one possible result from implementing a CRT (structured as a CRUT). The table compares the result of implementing a 20 year term CRUT paying 5% per year, funded with stock valued at $500,000, purchased for $250,000 ten years ago (long-term capital gain property) and sold by the CRUT upon receipt versus an outright sale of the stock. In both cases, the assumption is that the net sales proceeds are re-invested in a portfolio that appreciates at 7% per year, yields 1% annually, and is subject to 10% turn-over each year. Additional assumptions are found at the bottom of the table.

As calculated using the described assumptions, while a philanthropist would accumulate $1,777,297 over a twenty year period if they simply sold the stock and reinvested the net, after tax proceeds, the total amount returned through implementation of a CRUT is $2,128,469 – an increased return of $351,172. In the case of the CRUT, the total return is split between the philanthropist and the charitable remainder beneficiaries – $1,225,413 to the philanthropist, $903,506 to charity.

Why Create a CRT?

Most individuals establish a CRT when they have an appreciated asset they seek to:

(1) diversify in a tax effective manner,

(2) receive an income stream, and

(3) benefit charity.

Appreciated, long-term capital gain assets are the ideal candidates for funding a CRT because of the CRT’s tax-exempt status. If a CRT sells an appreciated asset after it is contributed, the CRT pays no capital gains tax. Instead, all proceeds from the asset sale are available for reinvestment. Given this, most individuals establish CRT’s during their lifetime as a method of both setting aside assets for charity during their lifetime while continuing to benefit from those assets while living.

However, charitable remainder trusts are also useful vehicles for establishing a pool of assets to provide a loved one an income stream during their lifetimes, with remaining assets passing to a favored charity when the trust terminates.

Accordingly, you do see CRTs incorporate as part of an estate plan where the CRT is created and funded at the time of an individual’s death in order to provide an income stream to a loved one during their lifetimes (or for a term of years), with assets passing to charity upon completion of the CRT term.

Of course, this can also be done during a donor’s lifetime, as well (i.e., you are free to establish and fund a CRT and gift the income interest to a third party during lifetime). Note, though, that if an individual other than the CRT donor or their spouse is named as a CRT income beneficiary, whether the CRT is created at death or during lifetime, the value of the gifted income interest is subject to gift and estate tax. Of course, gift and estate tax is unlikely to be paid unless total non-charitable gifts made by the individual during lifetime and at death exceed the individual’s estate and gift tax exemption ($11.2 million for 2018, $22.4 million for a married couple).

Last Thoughts

If a CRT is in your future, consider naming a donor-advised fund (DAF) account as the remainder beneficiary. By naming a DAF account with an advisor you have selected, you can easily change the charity(ies) that ultimately benefit from the assets passing from CRT at the time it terminates.

The advisor to the CRT, or the DAF sponsoring charity, can make distributions from the DAF in accordance with a plan you have discussed and left with the advisor. While it is possible to structure a CRT so that you can change the tax-exempt entities benefitting from the CRT remainder interest, including provisions allowing you do this require you to give up other CRT provisions you might rather keep – such as the ability to serve as the CRT trustee.

Finally, CRTs are flexible vehicles. This post barely starches the surface of how a CRUT can be structured. Indeed, besides plain-vanilla CRUTs, there are NiMCRUTs, income-only CRUTs, and flip-CRUTs. Each of these CRUT variations provide interesting and creative ways of accomplishing both non-charitable and charitable estate and financial planning goals using various assets as funding sources for the CRT.

If you have any asset that you would like to diversify in a tax effective manner, while retaining an income stream from the asset and benefiting charity, a CRT may be a perfect fit for you. That said, because a CRUT must be created and administered, it probably won’t make sense unless funded with at least $500,000 (though a straight forward CRAT or CRUT may very well be justified at a lower funding point).

Author

-

Jeff Zysik is COO and CFO at DonorsTrust. He is an attorney and accountant with fifteen years of tax planning experience, focusing primarily on sophisticated estate and income tax concepts. Before joining DonorsTrust, he was managing-director and co-founder of Charitable Entity Administration, LLC (CEA).